Bitcoin's price has dropped sharply from its record highs in October 2025, losing approximately 44 % of its value from the peak near $126,000. The decline has brought the world's most widely held cryptocurrency to its lowest levels in roughly 15 months, dipping below $70,000 in early February and briefly below $67,000 in some trading sessions—the lowest since before Donald Trump's re-election. This steep slide erased nearly all of the gains built up under the pro-crypto anticipation that followed the 2024 election. Bitcoin's plunge coincides with a broader sell-off in risk assets and renewed investor preference for safe havens like gold, which has rallied sharply over the same period. Analysts note that the sheer scale of the drop reflects both systematic risk aversion and deep structural volatility inherent to digital assets, where sentiment can pivot quickly on macroeconomic data, regulatory news, and global financial stress.

Many market participants have interpreted Bitcoin's recent slide as a reminder of the asset's persistent volatility, a trait long discussed by analysts and investors alike. While crypto proponents sometimes held out the narrative of Bitcoin as “digital gold,” the recent divergence between Bitcoin's performance and traditional safe havens has challenged that thesis. Where gold has surged and retained relative investor trust in turbulent markets, Bitcoin instead has suffered sustained selling pressure, partly fueled by liquidation events and shrinking speculative interest.

Long-time market watcher Michael Burry, known for his role in predicting the 2008 financial crisis, wrote on his Substack that he believes there is «no organic use case reason for Bitcoin to slow or stop its descent,» underscoring deep skepticism among some high-profile investors about the cryptocurrency's resilience as a store of value in moments of systemic fear.

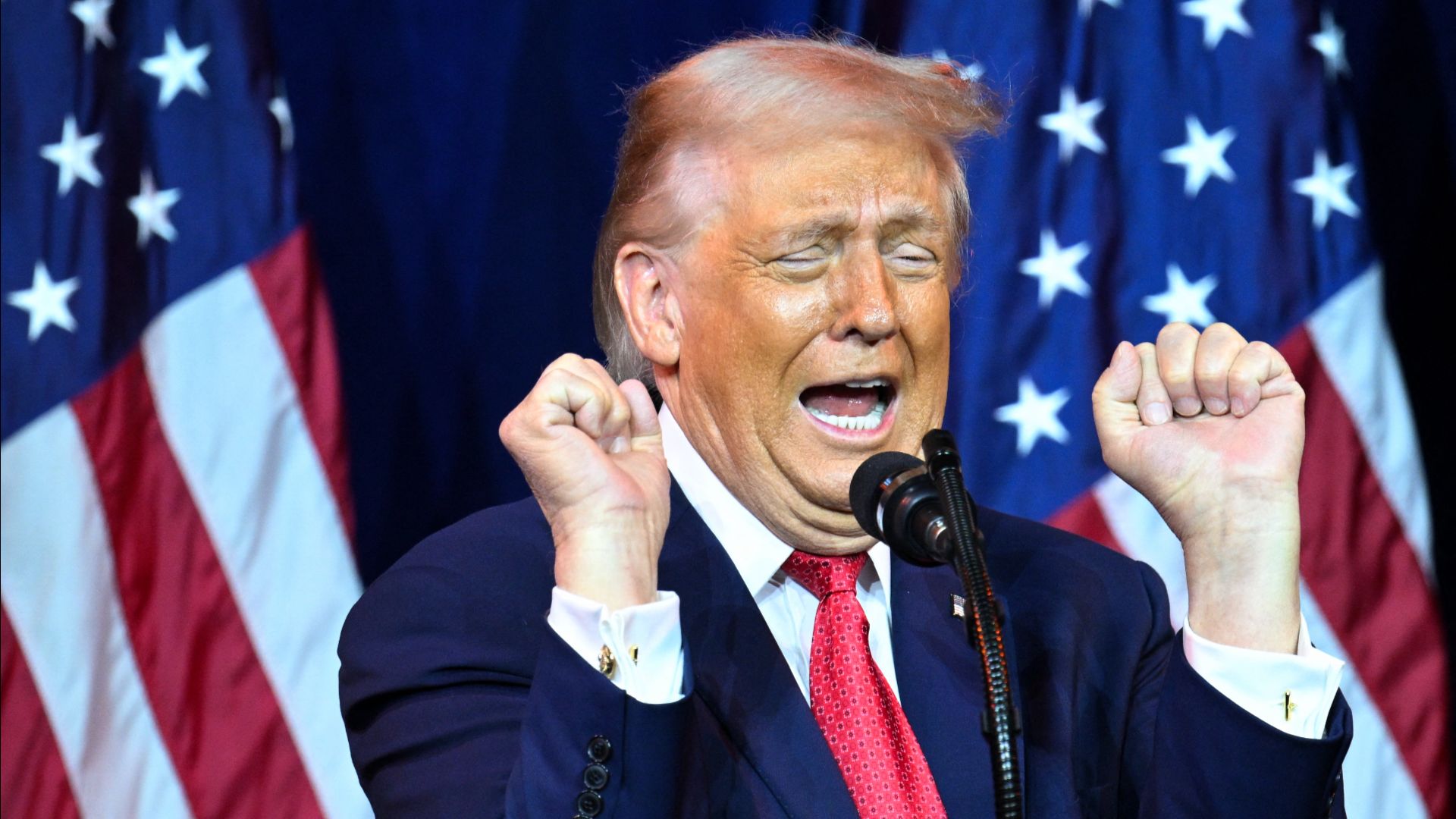

«Together we will make America the undisputed Bitcoin superpower and the crypto capital of the world.»

-Donald Trump

Economists and strategists warn that the structure of Bitcoin markets itself amplifies volatility, especially when macroeconomic signals push investors toward or away from risk assets. Bitcoin's decline has occurred alongside broader pressure on technology stocks, concerns about Federal Reserve policy, and geopolitical uncertainty, all of which can increase risk-off behavior among institutional and individual investors. A strategist at a major investment firm recently noted that capital flows tend to rotate toward traditional safe havens when fear gauges climb, leaving Bitcoin vulnerable to sell-offs that are deeper than those in equities or conventional commodities. In addition, thin liquidity and heavy leverage in crypto trading can exacerbate price moves, meaning that once sentiment turns negative, Bitcoin can decline rapidly with little resistance until new support levels are found.

Bitcoin's downturn has erased much of what had been dubbed the “Trump rally,” a period when optimism around cryptocurrency adoption under Donald Trump's presidency helped push prices to historic highs. Early in his term, Trump actively shifted his stance toward digital assets, a marked departure from his previous skepticism. As part of a broader executive push in early 2025, Trump signed an order establishing a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile, designed to treat Bitcoin and other seized crypto holdings as long-term reserve assets held by the federal government. That move was seen as elevating cryptocurrency's status, with the White House fact sheet noting that the policy aimed to position the United States as a leader in digital asset strategy.

«No organic use case reason for Bitcoin to slow or stop its descent.»

-Michael Burry, the Big Short investor

Trump also publicly set an ambitious goal for the U.S. cryptocurrency landscape, telling attendees at a digital asset summit that his administration would make America the “Bitcoin superpower” and “the crypto capital of the world,” framing digital assets as central to technological innovation and financial competitiveness:

«Together we will make America the undisputed Bitcoin superpower and the crypto capital of the world.»

Critics, however, have pointed out that markets did not sustain a rally following the announcement, illustrating the limits of policy endorsement in countering volatility. Other aspects of Trump's crypto agenda included calls for clearer regulatory frameworks and the disbanding of enforcement units, which removed some pressure on major exchanges and encouraged institutional involvement. Nonetheless, the stark downturn underscores the persistent question of whether policy enthusiasm can offset fundamental market forces when investors reassess risk exposure.

As Bitcoin sits near its lowest price in over a year and volatility indicators remain elevated, many investors and analysts are weighing both long-term potential and short-term caution. Some strategists argue that current lows could attract new buyers who view Bitcoin as undervalued relative to long-term adoption trends, but they emphasize that regulatory clarity and macroeconomic stability will be critical to any sustained rebound. Others caution that without clear catalysts to restore confidence, Bitcoin may continue to languish or test new support levels, especially if broader markets remain jittery. The juxtaposition of Trump's pro-crypto policies with a dramatic price slide illustrates the complexity of digital assets as both a political narrative and a financial instrument, and highlights why volatility remains at the core of the Bitcoin story.

Created by humans, assisted by AI.